Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

Discover fast, reliable and secure banking, whenever, wherever on the FNB App. Enjoy full control of your banking 24/7 without the need to go to a branch. Plus,the FNB App is free to use on all major networks. No data costs are charged no matter how many transactions or how long you use the app.

|

Do your day-to-day banking:

You can also buy:

|

You also get additional features that include:

|

Visit your App Store to download the FNB Banking App today. Just register and you're on your way.

Downloading the FNB Banking App is compatible with Android™, Apple™,BlackBerry™ and Nokia™ Symbian devices*.

For queries, email: fnbappsupport@fnb.co.za

To find out how to link your device call: 087 575 0362

View the software license agreement and remote banking agreement

*Android devices include HTC, Samsung, LG, Motorola, Sony Ericsson and Huawei.

BlackBerry devices include the Torch, Storm, Bold and Curve that are OS5 or higher

Terms, conditions, rules and standard network rates apply.

Bank safely and securely 24/7 with Online Banking.

Online Banking is the convenient, real-time way to access your accounts. Pay, transfer, trade and invest using easy online navigation - all from the comfort of your couch.

Banking Online is:

When using your Online Banking, you pay no data fees.

|

With Online Banking you can do your day-to-day banking:

You can also buy:

|

You can use Connect to:

You can take control and protect your account by:

You also get additional features that include:

|

View our How to register for Online Banking demo

Terms, conditions + rules apply.

Bank safely and securely anywhere, anytime with Cellphone Banking.

Access your money by banking in the palm of your hands using your cellphone. Even without your bank card, you can now do your banking via Cellphone Banking.

You'll pay no data fees when you use Cellphone Banking.

With Cellphone Banking you can do your day-to-day banking:

You can also buy:

Dial *130*321# to register and start banking on your phone today!

For assistance, call 087 575 9405 .

Terms,conditions and rules apply. .

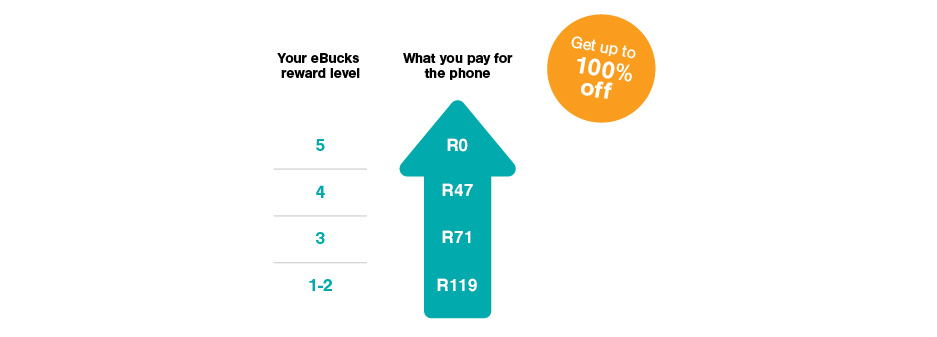

As a Gold customer, you can get up to 100% off your monthly fee for ConeXis X1.

Monthly discount fees are structured differently for Gold, Premier, Private Clients and Private Wealth accounts. Customers will be billed R119. Thereafter, the discount corresponding to the level they are on will be deposited into their bank account. Rebates will be paid within 48 hours.

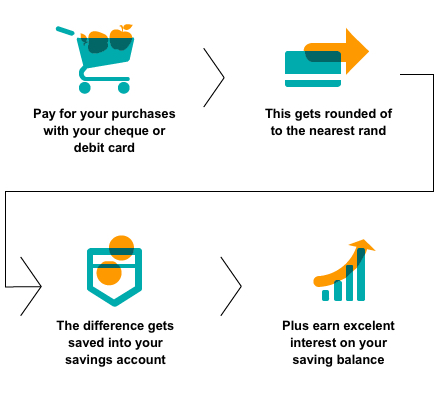

That's where we round your card purchase up to the nearest rand and transfer the difference into your Savings Account. This means that you save every time you swipe

How does Bank Your Change® work?

How do I access my savings?

1. Activate Bank Your Change® on Cellphone Banking:

Login to you Cellphone Banking account (Dial *120*321#)

Step 1: Select option 5 (Save and Invest).

Step 2: Select option 6 (Savings Account)

Step 3: Savings Account already exists. OR Select the option of the Savings Account to maintain.

Step 4: Brief explanation of Bank Your Change®. Select option 1 (Continue)

Step 5: Select Bank Your Change top-up amount (R0, R2, R5, R10, R20 or R50). Select relevant option.

Step 6: Confirm details and T&Cs. Select option 1 (Confirm)

Step 7: Confirmation screen for Bank Your Change

2. Activate Bank Your Change® on App:

Add or maintain Bank Your Change® to an existing Savings Account on FNB App

Step 1: Select ''Savings Account'' on FNB App

Step 2: Click the ''Bank Your Change®'' icon on the Savings Account settings to Add or maintain Bank Your Change®

Step 3: Select the top-up amount to be added to your left over cents every time you swipe, the options are R0 (bank left over cents) or R2, R5, R10, R20 and R50, then click ''Update''

Step 4: Click ''View Terms and Conditions''

Step 5: Tick ''I accept''

Step 6: Click ''Confirm'' to continue

Step 7: Click ''Finish'' on success screen - Updated the top-up amount

3. Activate Bank Your Change® on Online Banking:

Step 1: Click ''Manage'' Savings Account on account settings

Step 2: If you are requesting Bank Your Change®, Click ''Add''

Step 3: Choose a top-up amount to be added to your left over cents every time you swipe, the options are R0 (bank left over cents) orR2, R5, R10, R20 and R50, then click ''Update''

Step 4: Select the ''Terms and Conditions'' to open and tick

Step 5: Click ''Submit'' to continue

Click ''Finish'' on success screen. You can top-up your Bank Your Change® by choosing a top-up amount of R2, R5, R10, R20 or R50. Each swipe adds that amount from your transactional account to the cents you've saved on your purchases, into your Savings Account. To add a top-up amount follow the same process used to activate Bank Your Change® and select the option Change top up amount and follow the screen prompts.

5

Meet a fifth reward requirement from a new product group

4

Meet a fourth reward requirement from a new product group

3

Meet a third reward requirement from a new product group

2

Meet a second reward requirement from a new product group

1

Meet a first reward requirement from ANY product group

My Cheque |

The total value of your card purchases and Cash@Till® withdrawals is more than all your cash withdrawals at ATMs and branches during the month*. |

OR |

Have at least three debit orders off your cheque account. *ALL card purchases and cash withdrawals (Cash@Till® and ATM/FNB branch withdrawals) made using your FNB Aspire Credit Card and FNB Aspire Current Card will be considered for this requirement. |

Credit card |

Spend at least R2 500 on your credit card each month. |

OR |

Spend at least R750 online using your credit card each month. |

Digital Banking |

Make at least two financial transactions on the app. |

OR |

Have Connect spend of R200 each month. |

Borrow |

Have used your overdraft to the amount of at least R1 000 each month. |

OR |

Have a personal loan with original loan amount R10 000 where the debit order is set up from your FNB Aspire Current Account. |

Home and car |

Have a Wesbank or a FNB Vehicle Finance account with your car on nav>>Car. Setup a debit order from your FNB Aspire Current Account. |

OR |

Have a Home loan or a Smart bond that has a flexi facility with an outstanding balance of R75 000, where the debit order is set up from your FNB Aspire Current Account, or there is a salary stop order set up. |

Start to save |

Have a Linked Savings Pocket or Savings Account with a balance that grows by at least R250 each month. |

OR |

Maintain a minimum monthly balance in your FNB Linked Savings Pocket or Savings Account, FNB Aspire Current Account or FNB Fixed Deposit Account. If you have an FNB Linked Savings Pocket, Savings Account or FNB Aspire Current Account, you'll need to maintain a monthly balance of at least R5 000. If you have an FNB Fixed Deposit Account, you'll need to maintain a monthly balance of at least R10 000. |

Family and Insurance |

Have an FNB Life Policy with min cover of R400 000. Pay the premiums for your policy from your Aspire Current account each month. |

OR |

FNB Funeral Cover product of min R50 000. Have min two lives assured. Pay the premiums for your policy from your Aspire Current account each month. |

| 15% on fuel and Uber

If you spent R1 200 on fuel in a month, at any fuel station and Uber, you'd earn eB1 800 |

Rand value R180 back |

| 15% on groceries

If you spent R2 000 at Checkers & Shoprite in a month, you'd earn eB3 000 |

Rand value R300 back |

| 1,5% on shopping

If you swiped for R1 500 on your Credit Card in a month, you'd earn eB225 |

Rand value R22 back |

| 15% on connect

If you spent R200 on Connect airtime + data in a month, you'd earn eB300 |

Rand value R30 back |

That's a total of R532

back in eBucks and R150 on your FNB Smartphone every month

*Transacting on the FNB Banking App includes payments, transfers and purchases but excludes debit orders, deposits and viewing of accounts.

Qualifying spend excludes any device premiums linked to your contract(s).

Your Islamic Aspire account comes with a Islamic Savings Account that makes saving easy.

Get an Islamic Savings Account and keep your transactions separate from your Islamic Aspire Current Account. The Savings Account gives you immediate access to your money, helps you track your saving, makes it possible for you to schedule payments and allows you to Bank Your Change® every time you swipe your card.

The best part? It gives you a competitive profit share.

There's more with Aspire - you can apply for short and long-term credit. Short term options include the Temporary Loan. A Personal Loan, Home Loan, Car Finance are some of the options you can apply for under long-term credit.

In addition, your Aspire Current Account allows you to take out insurance. This includes Funeral Insurance, Life Cover, as well as car and household insurance.

Since Aspire goes with the value, you get the following with FNB Connect:

Make your money go further each month with more rewards and family benefits from eBucks.

Even more benefits you know and love

Even more family benefits

For more information on eBucks Rewards and how you can make your money go further, download the FNB App or visit www.ebucks.com .

*Discount excludes taxes. Terms, conditions and rules apply.

You may qualify for an Overdraft up to an amount of R150 000 to make those payments when you may not have enough cash available in your account.

What's more, you can apply from the comfort of your home through any of our digital channels , meaning you always have enough cash for those unforeseen expenses.

The best part is that you pay no fees for your overdraft if you don't use it.

Get up to 3x your monthly account fee back in value

When you spend at our partners

When you learn from home

When you stay connected

When you travel

Subject to eBucks earn rules

Islamic Aspire Current Account

We're talking unlimited day-to-day banking and rewards for banking better, knowing what you pay for every month and saving towards your dream.

Here's what you get

Get digital banking at no extra cost, two eWallet sends, inContact, card swipes, electronic transactions and prepaid airtime purchases - safely and conveniently.

Cash withdrawals of up to R2000 pm at FNB ATMs and cash deposits of up to R2000 pm at FNB ATMs and selected retailers.

Save money easily with a Savings Account and boost your savings with regular payments and Bank Your Change®.

Enjoy membership to eBucks Rewards and earn eBucks that never expire which you can use towards fuel, shopping and travel.

More value with

Get rewarded with 500MB, 35 voice minutes and 35 SMSs every month on your FNB Connect SIM when you qualify for eBucks Rewards. Plus get rewarded with an extra 500MB data every month when you spend* R100 or more on your FNB Connect SIM card and qualify for eBucks Rewards at the time that you spend.

*Free minutes apply to local calls only.

Islamic Savings Account

Your Islamic Aspire Current Account comes with an Islamic Savings Account that makes saving easy.

Make your money go further each month with more rewards And family benefits from eBucks.

Simple account management

Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010