Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

A guarantee issued to a beneficiary in South Africa is referred to as a Local Guarantee. A guarantee issued to a beneficiary outside of South Africa is referred to as a Foreign Guarantee.

FNB can issue guarantees directly to foreign beneficiaries or indirectly to foreign beneficiaries via a foreign bank.

Read more about the guarantees we offer in our Guarantees Brochure

Guarantees offered:

Guarantees

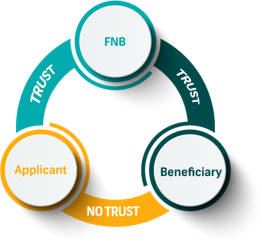

A guarantee is an efficient solution FNB customers can use to enable trust between two parties in a transaction. The guarantee replaces the need for one party to provide another form of security such as cash.

A guarantee issued to a beneficiary in South Africa is referred to as a Local Guarantee.

It replaces the need to provide other forms of security (such as a cash deposit), as the beneficiary knows they will be paid.

The security (such as a cash deposit) can be invested in an interest-bearing account.

As the beneficiary relies on the guarantee, the transaction can proceed.

Indicates the business standing of the Applicant as FNB is willing to underwrite their obligations.

It removes the admin burden of getting the beneficiary to return security that has been provided.

Parties involved

As a minimum, the following parties are involved

Beneficiary

The party who relies on the guarantee as security against the risk of non-performance/default by the applicant

Applicant

The party applying for the issuance of a guarantee to cover the risk of their non-performance/default

Guarantor

The party who issues a guarantee on behalf of the applicant

Local and foreign guarantees

Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010