Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

Credit bureau keep credit related information of all credit-active consumers, this information is compiled on a credit report or credit profile Credit grantors submit payment information to the credit bureau on how well you are repaying your loans. The information submitted is both positive and negative information. The purpose of a credit report is to allow credit grantors to determine if you are eligible for credit, by assessing the amount of credit you already have and also looking at how well you repay existing loans. It is a risk for companies to give you a loan, therefore they must ensure that you can repay it.

You can get a free copy of your credit report once a year directly from the credit bureau:

You are over-indebted if you are failing to meet your debt repayments and constantly need to borrow to support your monthly expenses.

What can i do if i am over-indebted?

There is no shame is asking for help to manage your debt. It is better to get help than to drown in debt.

Advantages

Disadvantages

If you would like to know more about debt counselling, you could speak to your bank, creditor or alternatively refer to the website of the National Credit Regulator www.ncr.org.za for more information. The telephone number of the National Credit Regulator is 0860 627 627.

Where to

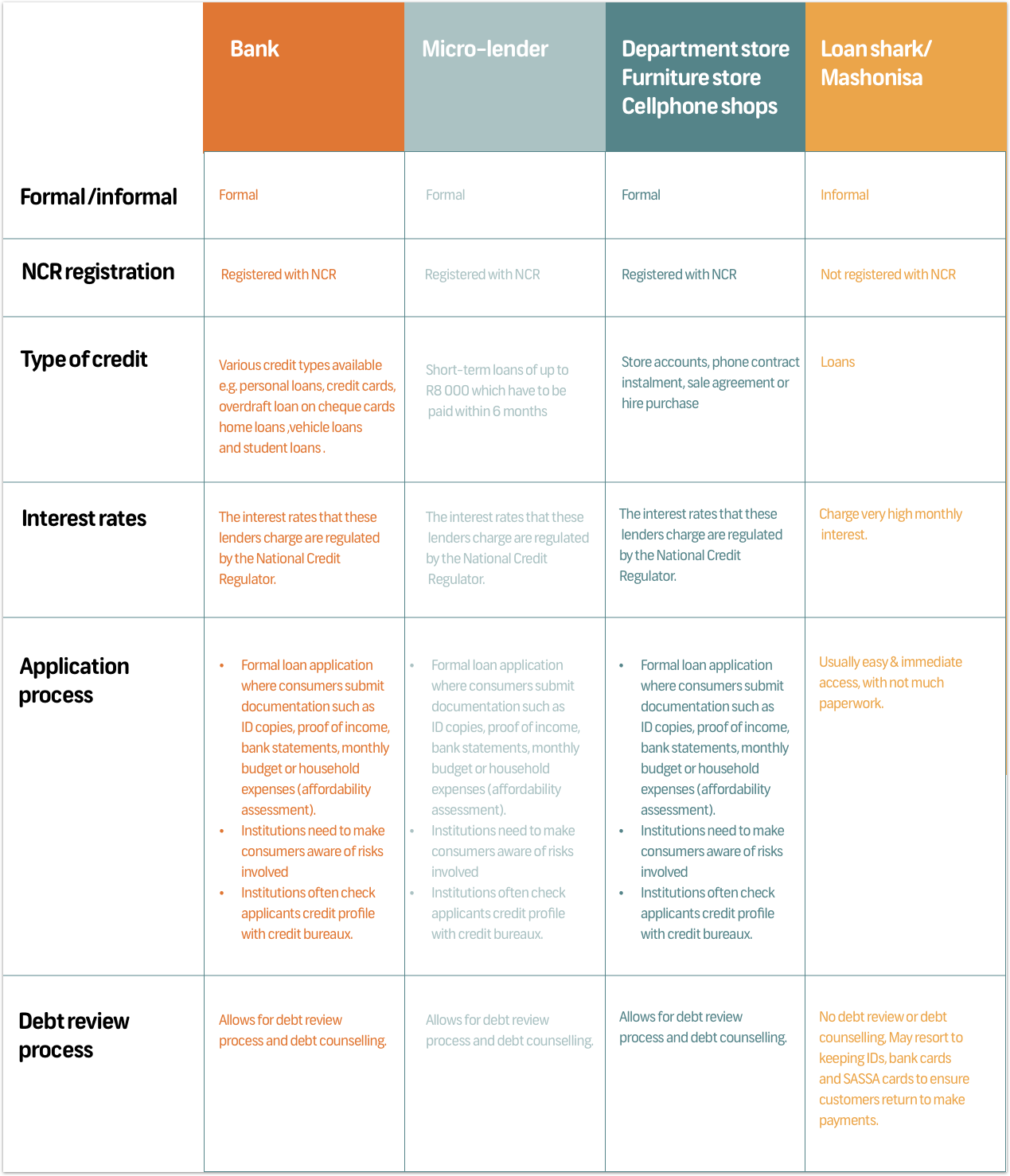

All these places offer different products and their terms and application requirements differ. The risk associated with each lender also differs, so think carefully before signing an agreement or contract.

It is important to look at the total cost you will pay by adding up the monthly instalments over the payment period. You may find you will pay way more than the cash price. Always check before agreeing to the instalments and where possible, save up and buy the item cash.

Remember: Check if you are being charged for extras such as delivery, credit life insurance, etc. You have a choice not to take up insurance if you do not want it.

There are two types of interest: interest earned (on savings and investments) and interest charged (on loans).

This type of interest is a way to grow your money and is a reward from the bank for saving your money with them. It's extra money you earn for saving your money with a bank or an investment/savings institution.

This is the type of interest charged by a credit provider to lend you money. It's the cost of credit and is usually calculated as a percentage of the amount that you borrow.

When interest is calculated on the original investment plus interest earned, so you earn interest on your interest, helping your money grow quicker.

When interest is calculated on the original amount borrowed invested plus any interest charged in previous months or years so you are charged interest on your interest, meaning your debt grows over time.

Instalments refer to a set amount you pay for an item over an agreed period. Often, we are attracted by special offers and low monthly instalments that look like very good deals. But 'low' instalments can be deceiving.

Where to

If you are planning to borrow money, there are lots of different places that you can borrow from including: banks, micro-lenders, shops and informal (unregistered lenders) such as loan sharks.

Taking up credit is a big decision. Before you do, consider the following:

Obtain a quote from the credit provider. It should show how much you will be paying in total.

Find out if there are penalties or rewards for repaying the debt earlier.

Get a copy of the contract and read it at home before you sign.

Make sure you understand the terms of the agreement.

Find out what will happen if you are unable to make the loan repayments on time.

Bad credit

The seller takes back the goods, as well as keeps the money you have already paid for the goods.

A judgement is a court order that forces you to repay your loans.

Depending on how big your debt is, the court can order that some of your property (such as furniture, a vehicle, etc.) can be repossessed.

The court will instruct your employer to pay a part of your wages or salary to the creditor as repayment of your debt.

Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010