Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

The Standalone option will not affect your Life Cover amount when a claim is made.

The combined option will reduce your Life Cover amount by the disability amount claimed. This type of cover is sometimes referred to as accelerated cover or a rider benefit.

Critical Illness Cover also offers a Temporary Premium Waiver Benefit. If you submit a Critical Illness claim that meets FNB's requirements, all premiums on your policy will be waived for 6 months.

| Own Occupation Cover | Activities of Daily Living Cover | Disability Combination |

|---|---|---|

| The own occupation disability option covers you in the event that you become permanently disabled and can no longer perform your own occupation, before retirement age. By your occupation we mean your trade, profession or type of work you do for profit or pay. It is not a specific job with any particular employer and is irrespective of location and availability. | The activities of daily living option covers you in the event that you become permanently unable to look after yourself and require help or supervision to perform daily tasks, like getting dressed for example. | You can choose to have either Own Occupation or Activities of Daily Living Cover, or you could choose to have both. If you have cover for both disability covers, you will be paid out for the first instance of disability in the event of a claim. For example, if you have Own Occupation and Activities of Daily Living Cover and you become permanently disabled and are not able to perform your occupation, then you will be paid out for this disability only. |

Financial Service Provider: First National Bank ("FNB"), a division of FirstRand Bank Limited, Registration No. 1929/001225/06. Authorised financial services provider (FSP No. 3071).

Product Supplier and Insurer: FirstRand Life, Reg. No. 2014/264879/06, insurer no 00102/001. Address: 4 Merchant Place, Cnr Fredman Drive and Rivonia Road, Sandton, 2196

Where you can claim the full sum you're insured for if you are diagnosed with a terminal illness by a certified medical practitioner.

Where you can receive an immediate 10% of the value insured as a pay-out to help with unforeseen expenses. You can choose to have this benefit activated on your plan at no additional cost, provided both you and your beneficiary have been an FNB or RMB customer for the past two years.

Earn up to 15% of your monthly premiums back in eBucks on your FNB Life Simplified Cover or FNB Life Customised Cover, if you meet the qualifying criteria.

As an FNB Premier, Private Clients or Private Wealth account holder, you also earn 1 000 points towards your eBucks reward level each month.

eBucks Rewards Terms and Conditions apply. For more details on the eBucks Rewards programme, and how to become a qualifying member, please visit www.eBucks.com.

Dealing with disability can be emotionally, physically and financially challenging. We also understand that everyone has different circumstances. This is why we offer you a choice of cover to best help you if you become permanently disabled.

Whichever option suits your needs, you have the flexibility of selecting either:

You'll also get a 6-month Premium Waiver Benefit, which means you'll make no premium payments for six months when your claim is approved.

We understand that illness or injury can have a significant financial impact on you, which is why we cover you for 33 specified illnesses and injuries. To further help you financially, when a claim is approved, you'll make no premium payments for six months.

To suit your personal needs, you can choose between:

Life Cover can be used to provide your family with an income to pay off debt, cover estate duty costs or even funeral expenses. It pays out a lump sum to your beneficiaries or to your estate in the unfortunate event of your passing.

We've kept your options simple:

FNB Life Cover - gives you more comprehensive cover up to R10 million, with the flexibility to add on benefits such as Critical Illness and Disability Cover.

To help you deal with life's complexities, Life Cover also offers you:

From R200 000 to R5 million.

We understand that illness or injury can have a significant financial impact on you, which is why we cover you for 33 specified illnesses and injuries. To further help you financially, when a claim is approved, you'll make no premium payments for six months.

To suit your personal needs, you can choose between:

From R200 000 to R10 million.

Dealing with disability can be emotionally, physically and financially challenging. We also understand that everyone has different circumstances. This is why we offer you a choice of cover to best help you if you become permanently disabled:

Whichever option suits your needs, you have the flexibility of selecting either:

You'll also get a 6-Month Premium Waiver Benefit, which means you'll make no premium payments for six months when your claim is approved.

Cover that matches your need

Superb value

This benefit pays out a monthly income (partial or full) should you become disabled or severely impaired.

Our Permanent Disability cover offers a lump sum pay-out should you be unable to perform your own occupation or if you are diagnosed and suffer from a permanent impairment.

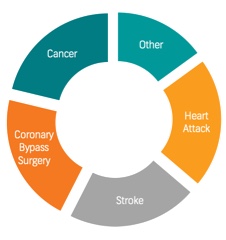

Our Critical Illness cover offers a lump-sum pay-out should you be diagnosed with a critical illness. This benefit helps you cover unforeseen expenses which can arise with certain serious illnesses such as paying for medical specialists or high treatment costs, 24/7 care or any other lifestyle adjustments you may need.

Our Critical Illness cover protects you against an extensive range of conditions such as cancer, heart attack, coronary bypass, surgery stroke, dementia, kidney failure, multiple sclerosis etc.

Summary of benefits include:

Additional benefits include:

Our benefits provide financial support to your dependants, help to settle outstanding debt, pay for your children's education or pay your estate taxes.

Proactive claims

We know how to pay out claims fast! We search home affairs and proactively find claims that need to be paid out. Over R200 million has been paid out to date.

Terminal Illness Benefit

Get paid out 100% of your death cover benefit should you be diagnosed with a terminal illness and have less than 12 months to live.

Help your family with immediate expenses

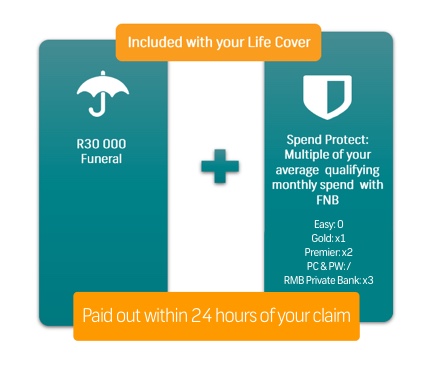

Your Life Customised policy includes an additional R30 000 Funeral and a Spend Protect Benefit. These benefits will be paid out to your nominated beneficiary within 24 hours of your claim.

Your Spend Protect Benefit, which is limited to 10% of your Life Insurance amount, pays out a multiple of your average monthly FNB/RMB Private Bank card swipes and any loan repayments to FNB/RMB Private Bank.

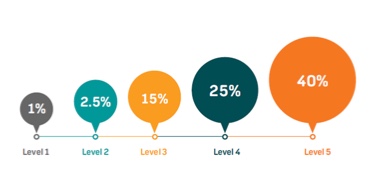

The multiple will be determined by your transactional account type held with FNB/RMB Private Bank.

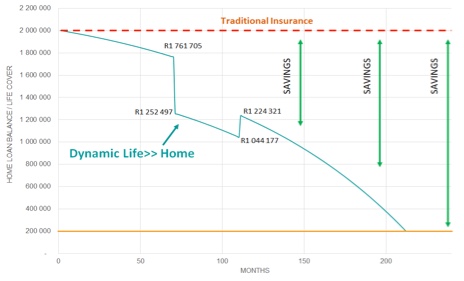

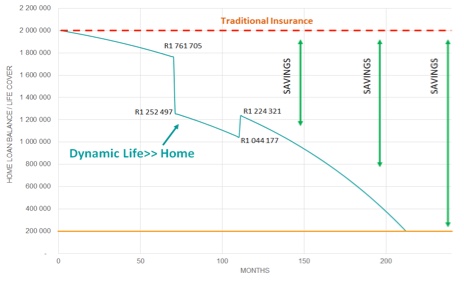

Dynamic cover that changes with your Home Loan

Cover that matches your need

Superb value

Let us help you protect your income by adding cover for retrenchment or inability to earn an income.

The benefit will help you manage your monthly financial obligations.

The benefits include:

Summary of benefits include:

Important benefit exclusions to note:

FNB Life Insurance

Life Insurance shouldn't be a one-size-fits-all. This is why we offer a product range which can be personalised to meet your unique needs and profile.

Our goal is to create life insurance products with you, our customer at the centre - in death, disability, critical illness or retrenchment

Earn up to 40% back in eBucks on your FNB Life Customised or Dynamic Life monthly premiums.

Earn up to 25% back in eBucks on your FNB Life Simplified monthly premiums.

As an FNB Fusion or Cheque account holder, you could collect up to 2500 points towards your eBucks reward level each month.

To find out how to collect points and earn eBucks from your Life Cover, or for more details on the eBucks Rewards programme, please visit www.eBucks.com.

eBucks is embedded in the insurance product and earn depends on meeting and maintaining qualifying criteria.

Dynamic Life» Home

Whatever happens, ensure you have a

roof over yours and your loved ones'

heads.

How to get Life Insurance online

Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010