With the help of your budget, and a more disciplined approach to spending, you've found a few extra rands to save each month. So what type of interest bearing account have you chosen for your savings, and are your savings earning compound interest?

Do not make the mistake of putting your savings into a transactional savings account. Your money will earn no interest and will actually reduce each month because of monthly fees and any transactions on the account. You need to put your money into an interest bearing account that earns compound interest. In this way, while you're working hard for your money; your money will be working hard for you.

What is compound interest?

Compound interest is interest earning interest on interest on interest. For example R1 200.00 earning annual interest of 10% will achieve R1 320.00 at the end of year one. The next year, with compound interest applied to the R1 320.00, the amount will be R1 452.00 in year two. The longer you leave the money where it is, the quicker the amount grows as compounding interest is applied to a larger and larger amount.

Compounding interest is not pretty when applied against your debt (usually applied monthly), but when you use it to grow your own personal wealth, it's like free sweets.

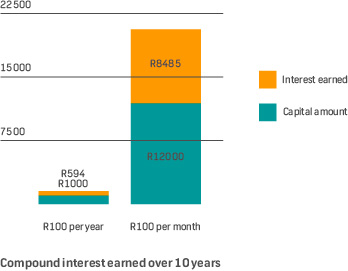

To make the most of compound interest, you need to deposit money into your savings every month. For example: saving only R100 per year into an account that realises compound growth of 10% per year will amount to R1 593.74 after 10 years. If you were to invest R100 per month over the same period (10 years), this money will achieve a compound growth of R20 484.50.

What are you saving for?

You need to decide what you're saving for: a rainy day, a deposit on a house, or your retirement? Knowing this will determine what type of savings vehicle you use. It's also time to change your attitude about saving - your savings are an investment in your future, and investment accounts, which provide compound interest rates that are higher than the rate of inflation, are the best savings vehicles.