Diversification has been a hot topic recently with focus on the importance of investments being geographically spread. Should the JSE see a reduction in growth, your investments in international markets might see higher growth and balance your returns out. The JSE currently represents 1% of the global investment market and by limiting your investments to South Africa, all your risk is concentrated in one location. For South African investors, globally diversifying a portfolio by obtaining international assets has become crucial in enhancing portfolio return and reducing overall portfolio risk.

Current global opportunities.

US technology shares have done exceptionally well over the lockdown period, due to higher demand for services as well as positive investor sentiment.

Alphabet was founded in 1998 (as Google). The company operates across three divisions. Google Advertising is split between Google Properties (Search, Gmail, Maps, Play and YouTube) and Google Network Properties (Google Ads, Google Ad Manager, and Google Marketing Platform). Google Other Revenues include apps, in-app purchases and digital content from the Play Store, Google Cloud and Hardware. Other Bets include revenue from internet and TV services, licensing and R&D services, and nest branded hardware.

Current valuation, prices in most of the short-term risks and looks appealing when taking cognisance of longer-term opportunities. Alphabet is also attractively priced within the tech space, with a forward PE rating in the low twenties, unwinding into the teens over 24 months.

Amazon is one of the largest e-commerce and cloud computing companies in the world.

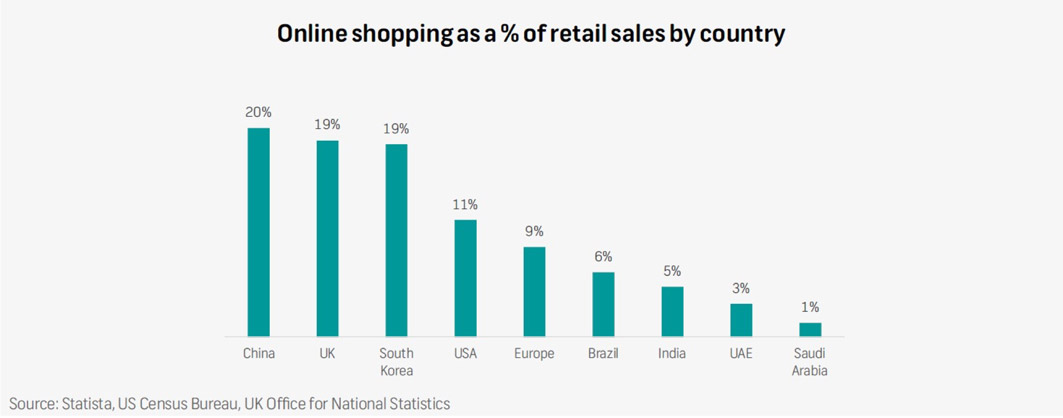

Self-isolation efforts due to the coronavirus may push people to try using online services for the first time, likely resulting in an acceleration of the online shopping trend.

Microsoft is a leader in enterprise and infrastructure software globally, offering operating system software, application software and server applications/enterprise software. The delivery of the offering includes on-premise and cloud-based solutions including Azure, the company's integrated public cloud platform. Microsoft also offers adjacent products in gaming, search/display (Bing), communications (Skype) and hardware.

The current coronavirus disruption may have some temporary impact on demand of new PCs. The increase in the number of people working from home may further accelerate cloud adoption.

Coca-Cola (KO) is the world's largest non-alcoholic beverage company with over 500 brands in over 200 countries. The company manufactures, markets and sells beverage concentrates, syrups, and finished beverages to authorised bottling partners. Depending on the product, KO's bottling partners combine the concentrates with sweeteners, still water and/or sparkling water to prepare, package, sell and distribute finished beverages. The beverage categories that KO operates in are sparkling soft drinks, water, enhanced water, sports drinks, juice, dairy and plant-based beverages, tea and coffee, and energy drinks. In addition, KO owns and markets four of the world's top five non-alcoholic sparkling soft drink brands namely Coca-Cola, Diet Coke, Fanta and Sprite.

Although 2020 will most likely see profits go backwards, we believe that when the global shutdowns end, KO will be able to grow profit in the high single digits due to mid-single-digit sales growth and improving margins. KO offers a forward dividend yield in excess of 3% which is regarded as attractive in the international context.

Accessing these companies

To gain access to US listed companies, local investors need to open an international stock broking account and comply with South African tax thresholds. This will allow South African investors to purchase and physically own these US stocks by buying them on an international exchange. Investors can also buy a "basket" of offshore stocks through exchange traded funds listed on the JSE or buy buying unit trust funds with an offshore focus.

A new alternative has also recently been launched on the JSE where South African investors can obtain exposure to these global companies individually through the purchase of locally listed exchange-traded notes (ETNs).

Unpacking exchange-traded notes

An ETN is a type of security, issued by a financial institution. An ETN tracks the value of a basket of shares or individual shares, for example offshore companies like Amazon, Tesla and Netflix to name a few, and trades on stock exchanges like the JSE. An ETN's price fluctuates based on the underlying index performance. Meaning if an Amazon ETN is purchased, the price of the ETN will increase based on the performance of the Amazon share itself.

Investors do not physically own any shares; however, they obtain exposure to the company's performance based on the fluctuating ETN price. The better the company performs, the higher the price of the ETN and the more profit investors will make.

Advantages of these ETNs:

Risks of these ETNs:

In summary:

Whether opening international broking accounts, buying ETFs or unit trusts, or obtaining exposure through ETN's, international markets cannot be ignored by local investors. Make sure you understand the various options available to you and the costs involved before you invest. Regardless, South African investors should give themselves the best opportunity to generate sustainable returns through investments in multiple geographic locations and sectors.