Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

After the all-in body attack that was January 2021, it's clear that the spread of Covid-19 and the associated global economic crisis will be competing for news headlines with eye-opening world events from vaccine nationalism to military coups, unprecedented presidential censures, disputed elections and feeding frenzies from retail investors.

Against this backdrop, we turn to our Chief Investment Officer, Patrice Rassou, to put some perspective on the year past and to highlight the big issues facing world markets in 2021.

Here at FNB, we stepped into 2021 with the outstanding news that we had been recognised as the Global SME Bank of the Year at the recent Global SME Finance Awards ceremony. The SME Finance Forum, which is managed by the International Finance Corporation, is renowned as a knowledge centre for data, research and best practice in promoting small-, micro- and medium-sized finance options. In addition, we have been named the Sunday Times' Best Business Bank in South Africa for the seventh consecutive year.

These achievements underline the innovation of our product and service offering and, as we head into this new year, it remains our aim to continue delivering top-class, world-beating solutions and convenient and secure digital channels.

Of course, relevant and quality advice remain the cornerstone of our offering, which is why we also include an analysis of the recent tax law changes in South Africa, specifically with regards to the country's policy around 'loop structures'. Many of these current changes are linked to government's focus on overhauling the current exchange control environment into a capital flow management system. Our focus is on what these changes mean for you?

Turning to opportunities on the horizon, an exciting inclusion for Africa-focused investors is an article exploring the growing interest in alternative assets and the opportunities inherent on the continent. Alternative investments across Africa are, traditionally, the domain of investment platforms such as venture capital, private equity or even angel investing, but we are also seeing pension funds edging into this space - particularly into investments such as renewable energy and infrastructure. It is also becoming clear that the roll out of digital infrastructure is another area of potential in an increasingly tech-focused future.

Until we meet again, stay safe.

Best wishes,

Eric Enslin,

CEO FNB Private Wealth

The human tragedy of 2020 was accompanied by an economic crisis as global economies shut down to try slow the spread of Covid-19. In addition, politicians in the developed world kept financial markets on edge over the year as an acrimonious United States election and the finalisation of the Brexit deal both went down to the wire. As we step into 2021, investors continue to be challenged in their long-term thinking as they contemplate whether a hazmat suit is still the only protection against a deadly virus. So, where to from here?

An eye on global markets

The global lockdown and halt to economic activity in the first half of 2020 floored all economies. Central banks unleashed unprecedented swift actions with a combination of aggressive monetary expansion and fiscal stimulus. Governments across the world tried their best to provide financial support to businesses and individuals, who saw their means of earning a living crushed unexpectedly. Interest rates around the world were pushed to the zero bound as central bankers aggressively cut rates and flooded capital markets with liquidity. The ploy was straight from the global financial crisis playbook - but on steroids - as the world's largest central banks did in a single quarter four-fold more quantitative easing than during the whole of the 2008 financial crisis. This approach will continue in 2021, with the new Biden administration in the United States planning more than US$2 trillion in stimulus with 80% of Americans likely to receive a stimulus cheque - an eye-popping number given that less than 20% do not work.

The bond market rally was followed by an equity market rebound. First, beneficiaries of the work-fromhome trend led the rally. But in the second half of 2020, as economies re-opened, a broader based rally ensued. With cheap money available, new participants joined the buying frenzy on several online apps - the so-called Robinhood effect. The amateurs jumped on the momentum bandwagon gobbling up Bitcoin and Tesla, racking astounding gains that are up more than 600% since March. These gains continued at the start of 2021 with Elon Musk briefly overtaking Amazon's Jeff Bezos as the wealthiest man on Earth.

The fourth quarter benefited from the additional fillip from the creation of vaccines, which added to the reopening trade. The S&P broke its record levels 33 times last year and the rally saw it rebound almost 70% from March lows.

The West Texas Intermediate oil price, which had turned negative earlier in the year, passed the more respectable US$50-per-barrel mark. Pharma stocks also attracted much interest, with Moderna up more than 200%. Globally, earnings declined by some 15% and valuation multiples expanded - but, as we know, markets wrote off 2020 and fixated on a more promising 2021.

Outing Agent Orange

In the United States, a blue sweep was regarded as a low probability outcome by most political commentators. While a Democratic win was seen as underpinning a much stronger fiscal response, this raised concerns about the impact of more aggressive fiscal action on the inflation. US 10-year yields spiked from record lows to end the year above 1% as inflation expectations also climbed. However, markets quickly shrugged off the impact of a contested election outcome even as outgoing President Donald Trump was making various erroneous claims about voting irregularities. Just as the Democrats were about to cement their control of the Senate after winning both seats in Georgia in January, Trump supporters stormed the Capitol - something unimaginable for a country born out of democratic principles.

After internet giants shut down Trump and his acolytes, who had instigated the riots, there have been many discussions about the role of social media in allowing 'alternative truths' to take hold in society. Trump's Make America Great Again campaign had become a proxy for a brand of nationalism and isolationism that was openly anti free-trade and anti-immigration. It also exploited the resentment caused by growing income inequality.

Local headwinds

South Africa's hard lockdown in April severely impacted the economy, which had been moribund for years. The R500 billion stimulus package (10% of GDP) failed to live up to expectations. The R200 billion loan support for small business was hardly drawn down and corruption took a bite out of some of the initiatives meant to combat the virus. Relative to the rest of the world, South Africa remains in a growth trap with constrained fiscal muscle but attractive real yields.

It should come as no surprise that South African bonds outperformed last year, posting very decent returns of 8.6%. The All Share made a strong comeback over the second half of 2020 to close the year up 7%. Despite being up some 21% in the finalquarter, property stocks lagged and were down 34% last year. Resources stocks remained the best performers for the year, up over 21% driven by strong commodity prices, with iron ore prices up an astonishing 77% as Chinese demand rebounded and supply remained constrained. Globally, the picture looks different with equities leading the way, up 22% in rand terms, while bonds were up 9% in rand terms (in large part due to the local currency's weakness).

The impact of the Covid-19 pandemic has also been exacerbated by the fact that lower income groups have been more vulnerable to the disease and suffered greater economic hardship in the form of job losses.

A role for green, sustainable investing

The coronavirus is just another example of a pathogen that has been transmitted from animals to humans. With human encroachment into natural habitats it is likely that we will see more outbreaks of this nature in the future. In addition, global warming has led to the migration of 70% of the world's animal species to cooler climates. The crisis has reinforced the fact that sustainable investing requires us to question the impact that companies have on the environment as well as society.

Internet companies have also come under the spotlight over their role in spreading fake news. Disinformation is now widespread, with some high-profile political campaigns - such as Brexit and Trump's election push - being underpinned by such disinformation. Right now, we are seeing the roll-out of Covid-19 vaccines being undermined by conspiracy theories.

Where to from here?

As the vaccine is rolled out in 2021, the human toll of the virus should stabilise and this should assist with the re-opening of economies around the globe. Then excess savings accumulated during the crisis will be put to work. Markets have already anticipated this, and valuations have discounted some of the good news. Global equities trade on a forward PE of 21 times compared with a long-term average of 18 times - which shows that the earnings rebound expected in 2021 has largely been discounted.

A world-class offering

In assessing the contenders, the international judging panel looked at the quality of the standard banking services available to FNB small business clients - such as top-class transactional, credit, invest and insurance capabilities - but also the additional valueadded services on offer.

The aim of the latter is to give self-employed customers and owners of SMEs easy-to-use resources that will help them to develop and grow their businesses, especially in the difficult and fast-evolving business environment of the pandemic. These resources are not merely financial in nature, but also assist FNB clients to recognise trends and capitalise on them by pivoting their offerings to cost-effectively meet new market demands.

"We don't see our role as merely providing a top-class banking platform. It's about taking a holistic view of nurturing and growing small businesses," explains Little.

Currently, small-, micro- and medium-sized enterprises (SMEs) make up 91% of formalised businesses in South Africa, according to the Banking Association. They employ about 60% of the labour force and account for more than a third of the nation's GDP

Small businesses are the cornerstone of South Africa's economic development and a potential salvation for job creation. So supporting this vital sector is an imperative for the country. FNB heard the cry and now our efforts have been recognised on the world stage.

The recent recognition given to FNB as the Global SME Bank of The Year for 2020 at the Global SME Finance Awards is an accolade not only for FNB and South Africa, but a benefit for the economy as a whole. The award has been made annually since 2012 and was won against stiff competition from top banks around the world.

This is the first time a financial institution from South Africa has won the award, says Gordon Little, CEO of FNB Commercial.

A world-class offering

In assessing the contenders, the international judging panel looked at the quality of the standard banking services available to FNB small business clients â such as top-class transactional, credit, invest and insurance capabilities â but also the additional valueadded services on offer

The aim of the latter is to give self-employed customers and owners of SMEs easy-to-use resources that will help them to develop and grow their businesses, especially in the difficult and fast-evolving business environment of the pandemic. These resources are not merely financial in nature, but also assist FNB clients to recognise trends and capitalise on them by pivoting their offerings to cost-effectively meet new market demands.

"We don't see our role as merely providing a top-class banking platform. It's about taking a holistic view of nurturing and growing small businesses," explains Little

Currently, small-, micro- and medium-sized enterprises (SMEs) make up 91% of formalised businesses in South Africa, according to the Banking Association. They employ about 60% of the labour force and account for more than a third of the nation's GDP.

The all-important National Development Plan envisages that this sector should create about 90% of all new jobs in the country by 2030. The current impact of Covid-19 on the economy â notably significant job losses in all sectors and particularly the increased shedding of positions by big corporates - makes the role of small businesses even more critical.

This, believes Jesse Weinberg, Head of the SME Customer Segment at FNB, makes FNB's offering all the more important at this critical juncture. "It's important to be more than just a bank. We want to go the extra mile and emphasise shared value with our clients. If they're successful, then we're successful," he says.

Extensive resources available to SME clients

Among the suite of resources available to selfemployed and SME clients are the following:

"When you bundle all of these offerings together and leverage them with the additional support that the bank provides, then you have a compelling offering for South African sole proprietors and SMEs, including those people who are looking to formalise their 'side hustle' into a viable business if they have become unemployed or under-employed due to Covid-19," says Little.

Helping SMEs to capitalise on emerging trends

"There is a totally different operating landscape for SMEs right now," observes Weinberg. "Almost without fail, they have to rethink route to market, how they market to clients, their relationships with staff, and their operational situations. They have to be lean and nimble in their decision-making."

Zinacare is one example of an SME client that has very successfully pivoted its core offering during the pandemic. A healthtechnology company that previously specialised in sexual health testing, it quickly added Covid-19 testing capacity and includes highly professional home testing in its offering.

For SMEs that are navigating the current �'new normal�', recognising and capitalising on emerging business trends is vital. Here the insights and mentoring resources provided by FNB play a valuable role.

In the SME market, says Weinberg, it's normal to talk about the 'three accesses': access to finance, access to market and access to education.

"Access to the customer has been completely turned on its head for many businesses," he explains. "If they can't trade via bricksand-mortar outlets anymore, what do they do? Go onto an online marketplace? Advertise online?"

Weinberg adds: "Many business people used to operate intuitively; now they find they are out of their comfort zone and their tradi tional areas of expertise. Perhaps they need access to finance and credit that they have never needed before? Maybe they should think about re-bonding their house?"

SMEs now need education and step-by-step advice more than ever, believes Weinstein. They require webinars, practical information and a new way of thinking in order to evolve their business model. This is where FNB's SME resources can help provide answers.

"There's a significant increase in the number of small businesses embracing e-commerce and digital enablement during Covid-19. So we see a lot of interest in our resources that deal with that aspect," he observes. "For example, we can guide them on how to start selling on Shopify and link up with Takealot for customer deliveries."

According to Little, one of the resources on Fundaba that can assist in this regard is a video interview with local Google experts, who discuss in simple and practical terms how to get your business noticed by customers on Google.

"There are a lot of those snippets on the platform. We work hard to ensure our content is fresh and userfriendly," he emphasises.

Among the other pandemic-related trends that could benefit SMEs is a clear preference by consumers to 'buy local' and support local businesses rather than large multinationals. There is also a move away from shopping in large regional malls â with their higherpriced premium global brands â to strip malls in local areas that offer good value.

Vumela Enterprise Fund assisting high-growth SMEs

Another way that the bank supports small business is through the Vumela Enterprise Fund. FNB Commercial, together with specialist SME investment company Edge Growth, manages the fund and through it makes equity investments into high-growth SMEs struggling to access finance through traditional channels.

Little says more than R300-million worth of equity and debt funding has been injected into small business through Vumela to encourage early-stage entities. "The idea is to focus on businesses that are making an impact in terms of job creation. We empower the shareholders to grow their businesses from a start-up into a more mature entity," he explains.

Interestingly, despite the perception of pandemicinduced business carnage throughout South Africa, there are surprising indications of resilience in the economy. Average turnover on FNB-held business accounts is, for example, back to where it was in February 2020 - before the pandemic struck.

Similarly, consumer spending patterns have rebounded strongly and, although they aren't quite back at prepandemic levels due to sectors such as tourism and hospitality being so heavily impacted, Little says you "get the sense that there is still some buoyancy in this economy".

This is, of course, good news for SMEs and for FNB's efforts to help grow the small business sector. "As a bank, we have put great effort into nurturing and advising SMEs. Not necessarily because it will be of immediate benefit to us, but because it is of long -term value to the country and our clients," stresses Weinberg.

Written by: Chantal Robertson, FNB Global Solutions Willem van der Merwe, Global Solutions Specialist FNB

South African Tax law stepped boldly into 2021; firmly in line with government's stated intention to modernise the country's existing exchange control system.

Last year the Minister of Finance, Tito Mboweni, announced Treasury's intention to transform the current exchange control environment into a capital flow management framework. This was first announced during the 2020 National Budget Speech, and essentially proposed an overhaul of exchange controls to take place over 12 months. To this end, three tax Acts were promulgated on 20 January 2021, of which certain sections address some of the exchange control changes:

The Tax Administration Laws Amendment Act holds particular interest fro from a wealth management perspective. Not least because it relaxes the country's policy regarding 'loop structures'.

What are loop structures?

A loop structure meant that South African residents were prohibited from holding any South African asset directly or indirectly through a non-resident entity. Inward loans were also prohibited.

A gradual relaxation to the loop structure restriction commenced in February 2018 when the South African Reserve Bank'�s (SARB's) reporting branch, Financial Surveillance (FinSurv) permitted a loop structure of up to a 40% investment by a corporate entity into a nonresident entity which would invest directly back into South Africa.

A further relaxation was announced on 30 October 2019 which permitted South African resident individuals to invest up to 40% in a non-resident entity that would invest directly back into South Africa.

In order to promote and encourage inward investment to South Africa, on 4 January 2021, the entire loop structure restriction was lifted, permitting South African individuals and South African entities to invest into an offshore structure which would invest back into South Africa.

Any loop structure created prior to these dates and in excess of the permissible percentage, must be regularised with FinSurv via an Authorised Dealer.

It is important to note that the South African Revenue Service (SARS) is simultaneously issuing legislation on the tax treatment of these structures. Therefore, from a cross-border planning perspective, it is key that both the exchange control and tax implications are considered carefully before making use of this latest SARB dispensation.

The finer details

While the abovementioned tax amendments were anticipated, it is notable that they apply from 1 January 2021. Therefore, effective immediately it is important to consider these amendments when making use of the loop relaxations or when making any change to an estate planning structure.

Rather than trying to punish those who implement the nowpermitted loop structures, the tax amendments are, in essence, aimed at closing possibilities to avoid tax.

To understand the changes, it is important to understand what is meant by a Controlled Foreign Company (CFC). In simple terms, a CFC is generally an offshore company of which more than 50% of shares are held by a South African resident. This resident can be an individual or a South African company.

Before the relaxation of the loop rules, a CFC would not have been allowed to invest in South Africa, as this would have been construed a 'loop structure', which was prohibited in terms of exchange controls. The tax amendments focus specifically on the rules dealing with the taxation of such CFCs, which will now be allowed to invest into South Africa.

When a CFC receives dividends from a South African company in which it owns shares, such CFC might benefit from a reduced dividend withholding tax rate, depending on the jurisdiction of the CFC and the terms of the double tax agreement between South Africa and the jurisdiction in question. Furthermore, when the CFC pays a dividend to the South African resident shareholder, such dividend could be exempt from tax. This would have created an obvious tax loophole when South African residents implement such a loop structure. The tax amendments provide that a CFC must now include a portion of a dividend received from a South African company in their net income (based on a formula). A reduction is received for dividend tax already paid. The amendment ensures that any dividends tax suffered upon the distribution of such a dividend by the South African company is considered. The South

African shareholder will also not be able to benefit from the di vidend exemption when receiving a dividend from the CFC.

Previously, when the South African shareholder sold the foreign share in the CFC to a non-resident third party, the capital gain was disregarded for taxation purposes. The amendments now provide that a South African resident shall not enjoy a capital gains tax exemption when selling shares in a CFC when the value of such shares is directly or indirectly attributable to assets in South Africa.

In line with treasury's long-term plan

The 2020 Budget Review outlined far-reaching changes to South Africa's exchange control system. Essentially, Treasury and the SARB are planning to replace the current system with a more user friendly and transparent capital flow management framework.

The main features of this new framework would look something like this:

These changes are squarely in line with global thinking. They also aim, with respect to changes on emigration, to align the treatment of South African residents and emigrants â thereby supporting the mobility of global citizens. Under the new proposals, natural persons (emigrants and South African private individuals) will be treated identically, subject to capital flow management measures.

The aim is to level the playing field between South African private individuals and emigrants, subject to tax obligations being met.

As Mboweni stated in his 2020 Budget Speech, it is also hoped that the changes will "open up new markets, promote regional integration [in light of South Africa signing the African Continental Free Trade Agreement] and contribute to economic growth".

What does this mean for you?

Broadly speaking, the new exchange control framework has implications for all South Africans, particularly those whom we refer to as 'global citizens' - those with interests abroad and investments offshore.

For our clients making use of the R1 million and up to R10 million offshore allowances, there will be little change to the current process. Individuals using the annual single discretionary allowance of R1 million for foreign investment purposes must provide a tax reference number. In addition, any use of the annual foreign investment allowance of R10 million requires tax clearance in terms of the SARS FIA001 process.

Any foreign investment transfers in excess of R10 million would require a special tax clearance process and would be subjected to a more stringent verification process, much like the current process. However, the latter process is also going to include assurance that the individual complies with anti-money laundering and counter-financing of terror requirements prescribed in the Financial Intelligence Centre Act, 2001.

What is important to consider is whether the tax changes outlined above would have an effect, and to what extent, on any proposed estate planning structure.

FNB's team of fiduciary specialist advisers can guide you through these discussions. For those looking to implement a structure benefiting from these relaxations, FNB has the ability via their offshore trust and fiduciary services provider, FNB International Trustees, to implement an offshore structure that can participate in the now-permitted structures. A fiduciary and structuring discussion should not be held in isolation and can benefit from the investm ent advice capabilities of FNB's wealth management team.

To initiate such a discussion please contact me, so that I can draw all the right experts from within our Financial Advisory and Global Solutions teams into the process.

As you grow and diversify your investment portfolio you will increasingly look beyond traditional assets such as stocks and bonds and towards the realm of alternatives; those private market assets that offer exposure to new approaches and markets. These opportunities are not as easy to access as picking a retail-focused investment off the shelf, which is why they are often the domain of venture capitalists and private equity experts, particularly in the African context.

"Even in South Africa you have the option of investing in private equity, but your options are quite limited," explains Chantal Marx, Head: Research and Content at FNB. "When it comes to investing in Africa ex-South Africa, you would more than likely have to be an ultrahigh- net-worth individual to tap into these options and you'd have to first identify which private equity or venture capital fund you want to 'back' to give you a decent return on of your investment."

Working with a private equity business with the likes of RMB Ventures, which invests in start-ups all over the African continent, is just one of doors open to investors looking to go this route. While RMB Ventures has a particular focus on funding both intellectual and human capital, other firms will offer a different approach and expertise across a range of sectors. This is why picking the right partner and investment avenue for your diversification ambitions is so important.

Different ways of investing

Alternative investments across Africa are, traditionally, the domain of investment platforms such as venture capital, private equity or even angel investing. In each instance, there are very clear reasons why these avenues are usually the preserve of the professional investor.

Marx explains: "Very few individual investors have the stomach for something like venture capital where, if you are really, really good you will only have a 20% success rate." This risk element is why, says Marx, the space has largely been the preserve of institutional investors and discretionary money.

That said, some pension funds are now edging into the world of alternative assets, particularly in investments such as renewable energy and infrastructure, which has a more certain return profile since the technology and processes you are investing in are tried and tested.

In the wake of Finance Minister Tito Mboweni's October 2020 Medium-Term Budget Policy Statement this trend may become even more of a factor - at least in South Africa â as the continued 'liberalisation' of Regulation 28 could see changes to exposure limits and guidelines for retirement saving investing into infrastructure projects. Currently pension funds can only invest 10% into alternative investments, including infrastructure, so these adjustments could create more opportunities for investors keen to explore alternative asset options.

In light of this drive, another option which is finding favour among some wealthy investors is a more hybrid approach that incorporates the tenets of venture philanthropy, which employs venture capital techniques and applies them to achieving socially focused goals. Marx explains: "For example, by investing in digital infrastructure in an area where there is no broadband access, an investor would likely make a pretty decent return due to the fundamental investment case, but they would also be investing in the upliftment of entire communities. For many, that broadens the appeal because the investment is actually making a tangible difference in the way that people live."

The opportunities

The roll out of digital infrastructure is just one area of potential. In the context of COVID-19, it is hardly surprising that healthcare is another important investment area.

Applying an alternative asset investment hat to this problem, explains Marx, means seeking to solve for a poor and underresourced African healthcare system not by following the old route of building brick-and-mortar hospitals by the thousands and trying to train doctors and nurses to see one person every 15 minutes, but rather by investing into telemedicine or digital medicine alternatives.

Similarly, she says: "If you think of learning, and the fact that a lot of kids don't have access to schooling, then perhaps your solution is investing in broadband infrastructure and digital education initiatives, rather than trying to build a school in every village."

The same goes for electricity. Instead of trying to build out electricity infrastructure that is focused around nuclear or gas or coal, investors could opt for direct investments into renewable energy, which is both cheaper and better for the environment.

Small-scale farming is another sector which is being galvanised across the continent thanks to innovations such as crowd farming platforms which connect smallholders to agricultural investors. This includes the likes of Nigeria's Farmcrowdy, which claims to have raised more than US$15 million for 25 000 farmers over four years, according to African Business magazine. Another agri-tech innovation highlighted by the magazine was South Africa's Livestock Wealth, which connects online investors with cattle farmers, or Ghanaian crowd farming firm Agripool, which negotiates leases on community-owned land to afford farmers legal protection.

The funding solutions being conjured through new online platforms are of particular interest, with Marx stressing that finding solutions in terms of funding for small-scale farmers is key to this African sector. "There is certainly a funding gap, since some larger institutions might not have the risk appetite to fund these smallscale farmers," she explains. "And yet there is a massive requirement for working capital every season. That means there is an opportunity - and a gap - there."

The challenges

While the opportunities are plentiful, there are very real challenges to this form of investment. Government buyin is one.

"When you are looking at something like agri-tech or broadband infrastructure or renewable energy, then the regulatory environment is supposed to aid those kinds of initiatives," explains Marx, "but in many cases they often hinder those kinds of initiatives."

Another issue, which is linked to the lack of liquid retail options, is that any investment is going to be tied in for quite some time.

Despite these concerns, Marx believes alternative asset investing certainly has a place in an emerging continent such as Africa. "What is great about going into areas that are relatively underdeveloped is you can use new techniques to solve for old problems in a much more efficient and cost effective way," she says.

FNB Connect has been offering exclusive SIM and smart device deals to FNB Private Wealth clients since 2015. Connect's improved quality network means that FNB Private Wealth clients can enjoy wider coverage on 3G and LTE networks and experience faster data connectivity than before. Clients can enjoy the following benefits of the FNB Connect SIM:

Garmin Fenix 6X sapphire

Lens Material: Sapphire Crystal Bezel Material: Diamond Like Carbon Coated Case material: Fiber-reinforced polymer with metal rear cover Strap material: 26mm quickfit silic

R689p.m.

x 24 months

Top Up Go

50 MB data,

15 voice minutes,

15 SMSs

Samsung Galaxy S21 256GB Dual Sim

The Samsung Galaxy S21+ 5G comes with a 6.7 inch touchscreen with 394PPI. It packs a 64-megapixel rear camera and a 10-megapixel selfie-camera. This is all powered by the Exynos 2100 International chipset and 8GB of RAM

R1439p.m.

x 24 months

Top Up L

2 GB data,

200 voice minutes,

300 SMSs

iPhone 12 Pro Max 128GB

Pro camera system with 12MP Ultra

Wide, Wide and Telephoto cameras, 4x

optical zoom range, Night mode, Deep

Fusion, Smart HDR 3, Apple ProRAW,

and 4K Dolby Vision HDR recording

R919p.m.

x 24 months

Top Up M

800 MB data,

100 voice minutes,

100 SMSs

Plus stand a chance to win 1 million eBucks when you buy any Apple product between 1 - 31 March 2021 at the eBucks Shop or FNB Connect

Ways to enter:

*Competition ends 31 March 2021.

Valid while stocks last. Product and Deal T& C's apply

As we edge ever closer to the end of a tumultuous year it is clear that the COVID-19 crisis is far from over, as we can see from unfolding events across Europe and North America. What is also becoming increasingly apparent is that the world is learning to adapt to this new reality. We see this unfolding in our own business and our own homes, as the uptake of digital solutions and platforms continues to underpin our working lives, our personal time and the future career directions of our children.

We've chosen to hone in on this digital theme in a number of articles contained in our final newsletter of the year, with a particular eye to the impact of artificial intelligence and digital banking on our own sector and how this might impact your wealth management experience in the future.

We also examine how this rapid acceleration of the Fourth Industrial Revolution can, and must, change the educational and skills-development focus of our children. The likes of the World Bank have long been talking about the importance of creativity, empathy and mindfulness as vital future skills and, following the events of 2020, it is becoming clear that these skills have a place not only in the classroom but also the boardroom.

And, not to neglect our downtime, we've even adopted a digital focus for the holidays by examining interesting and innovative ways you and your family can keep entertained and enthused. You'd be surprised at how much fun you can have from the comfort of your couch, be it exploring the stars, indulging in an online quiz, unlocking an escape room or enjoying a night in at the ballet.

Our digital future is not, however, the only innovation under the spotlight in this edition. We ask you to consider the possibility of turning your family WhatsApp group into a savings stokvel and welcome your thoughts and feedback in this regard.

We also turn our attention to offshore investing, in light of further indications of a possible phasing out of the country's current exchange control regulations, and we offer a gentle nudge to make full use of your R1 million annual Single Discretionary Allowance and R10 million Foreign Investment Allowance before 31 December.

As the year speeds to a close, we take this opportunity to remind you to remain focused and vigilant over this period, being ever mindful that fraudsters are always on the prowl. Finally, on behalf of the entire FNB Private Wealth team, I wish you and your family a peaceful festive season and a successful and prosperous 2021.

Best wishes,

Eric Enslin,

CEO FNB Private Wealth

Even before the COVID-19 pandemic changed our personal and professional lives in so many ways, the banking sector in South Africa and worldwide was undergoing fundamental and rapid change.

Digitisation, data science and the new frontier of artificial intelligence (AI) had all come together as part of a three-pronged process to provide clients - both in retail and corporate banking - with many innovative new banking solutions and seamless, hyperpersonalised user experiences.

The onset of the pandemic has only accelerated these trends and created new ways in which banking is now being conducted.

At FNB Private Wealth, for example, the pandemicrelated lockdowns reinforced the importance of client engagements and the need for a personal financial advisor, working in collaboration with skilled experts, to help our clients navigate the complexities of a turbulent and unpredictable world. In order to free up our specialists to undertake more meaningful engagements, and to help our clients solve for more complex financial needs and goals, we are increasingly incorporating supportive digital processes and platforms, as well as robo-tools, into our offering to enable clients to self-direct their affairs where needed. This collaborative interplay between human expertise and creativity and the efficiency of world-class technologies underscores the future of our relationship model.

While FNB is ahead of the curve, this approach is increasingly being adopted by other leading financial institutions as the sector as a whole responds to growing client demand for contactless banking, personalised advice and greater control of finances from afar.

A survey by Lightico, an international software company that helps businesses interact digitally with their clients, affirms this trend. Their research found that 82% of bank clients are now concerned about visiting a branch in person and 63% are now more willing to try digital applications.

For corporates, the work-from-home imperative requires that highly complex global banking be carried out easily and securely by multiple employees and managers in different locations.

Heightened uncertainty requires better decisions

This time of crisis and high uncertainty also heightens the need for rational, data-based business decisions by banks and their clients. This is where the use of AI in banking comes to the fore.

"If AI is all about making fast, effective and logical decisions, then its value is being enhanced by the pandemic," says Riyadh Bhyat, Head of EMEA for Quantium, an international analytics firm that works closely with top global banks. His view of AI's importance in banking is supported by a study from the UK-based Economist Intelligence Unit, which interviewed more than 300 banking executives from around the world for its annual study on The Future of Banking. Of all the advanced technologies available, 77% of executives believed that AI would be the biggest game changer. Of all the money invested by banks around the world in technology, AI is second only to spending on cybersecurity.

How AI helps the banking customer

Matthew Bernath, Head of Data Analytics within the FirstRand Group, says fraud analysis and detection is one of the most obvious ways that AI can assist the bank's clients. "When you go to a store and swipe yourcredit card, the transaction is instantly being analysed for fraud. In a split second, our AI models are running and analysing whether it could be fraud or is likely legitimate," he explains. "We are able to analyse thousands of transactions happening simultaneously and provide a response in milliseconds. If people in a back office somewhere had to do that, clients would wait for hours at the merchant for a decision."

Bernath says the bank uses AI in combination with simple digitisation and data science (all are mutually supportive but not to same) to create value for client and efficiencies for the organisation.

"AI mimics human behaviour and decision-making. So instead of a client having their loan application reviewed manually by a human loan officer - a process that could take a week - it can be done instantly when you fill out the form on the FNB App," he explains. "AI will automatically create a credit score, decide how much money can be approved, select the term of the loan and pick the applicable interest rate. This becomes something of a game changer," says Bernath.

Using the nav» button on the FNB App is another example of how AI, when integrated with other digitisation technologies, gives clients convenient access to an array of options and processes that would have been undreamed of 10 years ago. "You can sell your existing house; get pre-approval for a bond; buy a new house; buy a car; renew your car licence, get wellness advice and tips on how to manage your money - all while lying in bed on a Sunday morning," Bernath says.

Ethics and using AI for the greater national good

But there is more to AI applications than just convenience. Bhyat, for example, outlines how AI was used for the greater national good during lockdown. Quantium, which is headquartered in Australia, worked with the national government in that country to determine which industries and businesses needed financial and other support in order to stay afloat and preserve jobs. As AI becomes more advanced and more human-like in its capabilities, are people destined to increasingly be removed from the decision-making process? Are we creating a kind of automated, hightech,'big brother'?

Bernath thinks not and points out that there are already steps in place to mitigate this. "It is called 'human out of the loop', 'human over the loop' or 'human in the loop'. 'Out of the loop' is for a very low-risk process where, if it goes wrong, no great damage is done," he explains. "The other actions are in accordance with the level of impact, or damage, if the computer gets it wrong. In these instances, this is mitigated by having a human oversee the process, or by inserting a human into the process so that the computer cannot make a decision without a person's approval."

Both Bernath and Bhyat emphasise that the ethics around using AI in the banking space require a level of 'explainability'. The final word goes to the Swiss-based World Economic Forum (WEF) which, in a recent report on the way digitisation and technology is changing banking, highlights that the banking sector is facing many challenges in a COVID-ridden world.

"With the right strategy, banks have a unique opportunity to succeed in the long term. Pursuing advanced technology and digital ecosystems will be key to that success," says the WEF. "With these elements in place, banks will cut costs and drive efficiencies, helping them weather the coming storm and redefine their value to clients in a shifting market."

The Fourth Industrial Revolution (4IR) is upon us, embracing rapidly changing technology that will soon fundamentally change the way we live, work and are educated.

For schools, colleges, universities and training institutions, it is a time of uncertainty. What skills will be required by those who enter the workforce in five to 10 years? What current jobs and professions will even exist 15 to 20 years into the future?

A career path as a doctor has always been a solid choice. So too are ther dependable options such as a pharmacist, accountant, civil engineer or lawyer. Right? Apparently not.

360º skills shift

In an October 2020 article for the World Economic Forum (WEF), Hiroshi Tasaka, Honorary Professor at the Graduate School of Tama University in Tokyo and a special advisor to the Japanese Prime Minister, singled out these once-prime professions as being among those whose future is in doubt. The reason is they all require the application of professional knowledge and judgement based on logical thinking - two skills in which emerging artificial intelligence (AI) technology has an overwhelming advantage over humans. "Those who are engaged in simple manual work that can be replaced by robots, drones and automated driving will lose their jobs. However, these people can probably get new jobs by learning slightly more advanced skills in manual labour," Tasaka wrote. "A more serious unemployment issue created by 4IR is the prospect of many workers previously engaged in the knowledge economy (i.e. professionals) losing their jobs to rapidly developing AI."

Among the skills that cannot be replaced by AI, Tasaka said, are the ability to communicate and empathise deeply with customers; growth-management skills that help employees develop and grow professionally; counselling skills which enable workers to overcome stressful situations; and creativity.

Highlighting the value of creativity, he elaborated that this vital skill includes the ability to express a vision that motivates members of an organisation; skills that promote co-operation within a business; and leadership skills that enable an organisation to move forward smoothly when implementing innovative and often ground-breaking new ideas.

Tasaka's observations are broadly supported by other deep thinkers such as the United Nations Educational, Scientific and Cultural Organisation, which has emphasised the need for 'socio-emotional skills' including critical inquiry, mindfulness, empathy and compassion to equip young people to "effectively address the challenges of the 21st century". The World Bank has also talked of the importance of "teaching empathy and compassion in schools".

Rise of the 'touchy-feely' arts?

Does this mean that arts-based courses of study derided by many educators in the past, in favour of the hard sciences, are coming back into vogue? The answer, it seems, is a partial 'yes' - based on the reality that computers struggle to replicate these skills.

But experts hasten to point out that certain hard skills are still required in the 4IR world. It's just that they are different to the ones that have been taught in the past and which students have been inclined to study.

A global Disruptive Tech Survey by Get Smarter, a supplier of online short courses in partnership with various South African and international universities, found that the technologies most in demand are AI, data science, advanced analytics and machine learning.

But, says Get Smarter, interest in data science education in South Africa has been relatively low and adds that "South Africa's education system lacks a technology focus". To back up this statement, it quotes 2018 statistics from the Department of Higher Education and Training, which indicated that the share of highereducation students in programmes related to science, engineering and technology was less than 30% of total enrolments.

Professor Barry Dwolatzky of Wits University's Johannesburg Centre for Software Engineering (JCSE) agrees. In the wake of a 2019 ICT Skills Survey conducted by the JCSE in partnership with the Institute of Information Technology Professionals South Africa, Dwolatzky noted that this had highlighted "the poor state of education in South Africa and in particular the very low number of learners achieving competence in STEM (science, technology, engineering and mathematics) subjects".

Much of this he attributed to an underlying lack of appropriate curriculum, relevant teaching materials and skilled teachers.

A slow pivot for education

It's not that the powers-that-be are unaware of the challenges associated with equipping our population for the 4IR. In last year's State of the Nation Address, and again at the inaugural Digital Economy Summit, President Cyril Ramaphosa said more than one million young people would be trained in data science and related skills by 2030. "We are introducing subjects such as coding and data analytics at a primary school level to prepare our young people for the jobs of the future," he said.

Speaking in support of the president's objectives at a Council of Education Ministers' meeting in 2019, Basic Education Minister Angie Motshekga said thousands of teachers were being trained in coding, with the subject set to be piloted at 1 000 schools during 2020. She added that her department would also be introducing a robotics curriculum from Grade R to Grade 9 to provide a strong foundation in engineering. Whether these plans have survived the disruption of COVID-19 is unclear.

Private schools are also working to equip even their youngest learners with basic 4IR skills and are encouraging parents to play their part. At Curro, for example, learners are taught basic computing from Grade 1, but the group is adamant that parents must be involved in their child's digital literacy journey throughout. "The first exposure learners receive to technology is through their parents. While children certainly do watch and absorb their parents' digital behaviours, it is also the responsibility of parents to help their little ones become tech savvy through teaching," said Magdeleen de Kock, ICT Coordinator and CAT Teacher at Curro Krugersdorp.

She recommends parents introduce young children to basic coding through simple sites such as CodeMonkey and ScratchJR, for example. Participating in this process will give parents "peace of mind that their children are becoming better equipped to ultimately operate in the 4IR"", said De Kock.

When the group launched its Curro Online offering in May, during lockdown, Business Manager Jay Paul emphasised a strong focus on maths, science, coding and robotics - a response, he claimed, to the reality that "most home-schooling solutions do not prepare the learners for the technology-heavy 21st century". Only time will tell how the 4IR will play out in South Africa, Get Smarter observes. "But it seems clear that if the country is to become a legitimate participant in the coming revolution, it will need to make some fundamental changes first. Chief among these will be to combat the low levels of digital literacy."

This while not neglecting the equally important focus on developing soft skills. Apart from the empathetic and communication skills emphasised by Tasaka, the WEF was, as far back as 2015 in its 'New Vision for Education' report, highlighting "competencies such as critical thinking and collaboration, and character qualities including curiosity and adaptability" for the world of the 4IR.

The uncertainty around how, exactly, to get this educational balance right may be one of the reasons why the six leading private schools we approached for comment showed little interest in being interviewed. This could indicate the magnitude of the topic and, worrying, the inability of educators to adapt to this disruption with the necessary speed.

It is not surprising that most people are counting the days to the end of 2020, and are hoping for a brighter 2021! The news on the cross-border front is that National Treasury's proposed transformation from an exchange control environment to a capital flow management framework appears to be on track.

To provide further context, during his National Budget Speech in February, Finance Minister Tito Mboweni announced an overhaul of exchange controls to take place over the following 12 months. There has been some scepticism in the market as to whether these changes would happen given the turbulent year, but during his Medium-Term Budget Policy Statement (MTBPS) in October, Mboweni not only reaffirmed Treasury's intention to replace the current exchange control regime, but also announced some accelerated changes in the meantime to make it easier to invest in South Africa.

While it is tempting to jump straight into what to expect in 2021, it is important to ensure that we have not missed an opportunity in the here and now. With all the uncertainty and market volatility that we have seen in recent months, South Africans are continuing to embrace their status as true global citizens by moving money offshore. Due to the travel restrictions, this has been predominantly on the individual foreign investment side.

"Critically, moving funds abroad is no longer the preserve of the elite, there is more breadth and depth to the global conversations. More and more South Africans are looking to access the markets beyond our borders to ensure a more balanced investment approach," says Chantal Robertson, part of the Global Solutions team at FNB Financial Advisory. "Even with the current global pressures, I don't see this changing. South Africans are eager to participate globally and it is key that we are able to help guide them through this entire process, from the movement of the funds offshore to a comprehensive investment strategy."

Take advantage of your annual allowance Many South Africans are diversifying their portfolios by taking advantage of the R1 million annual Single Discretionary Allowance (SDA) for South African resident individuals aged 18 and older. For amounts above R1 million, tax clearance from the South African Revenue Service (SARS) can be obtained to move up to R10 million offshore annually as part of the Foreign Investment Allowance (FIA).

With 31 December fast approaching, those individuals who have yet to take full advantage of their SDA would be advised to do so, bearing in mind that the allowance includes travel, offshore credit card purchases, gifting and foreign investment. "For those South Africans who usually make use of most of their R1 million SDA on overseas travel, COVID-19 restrictions will have curtailed this," admits Robertson, "but this means that a large portion of your SDA may still be available for use. Just because you are restricted in terms of offshore travel, doesn't mean your money is."

While it looks unlikely that SDA and FIA limits will change in the foreseeable future, the bigger issue on the table currently are the serious - and noteworthy - structural changes on the cards.

A modernisation move

Looking back to February's Budget, when Mboweni first mentioned that the exchange-control process associated with emigration would be phased out over the next 12 months, a further reading of the Budget Review shows that the proposed changes on the exchange control side were much more far reaching than just emigration. National Treasury and the SARB are potentially planning to replace the current system with a more user friendly and transparent capital flow management framework.

The main features of this new framework would look something like this:

Notably, by aligning the treatment of South African residents and emigrants you support the mobility of global citizens. Furthermore, as Mboweni stated in his 2020 Budget Speech, the intention is to "open up new markets, promote regional integration [in light of South Africa signing the African Continental Free Trade Agreement] and contribute to economic growth".

It is further stated that individuals who transfer above R1 million and up to R10 million offshore in respect of foreign investment do not require prior approval, but will be subject to tax compliance. This is no different to the current process, meaning that where individuals use the annual SDA of R1 million for foreign investment purposes, a tax reference number must be provided. In addition, any use of the annual foreign investment allowance of R10 million requires tax clearance in terms of the SARS FIA001 process. The South African Reserve Bank (SARB) has advised that they will review these limits regularly.

Any foreign investment transfers in excess of the above would require a special tax clearance process and would be subjected to a more stringent verification process, much like the current process for individuals looking to make use of this special dispensation. However, this process is also going to include assurance that the individual complies with anti-money laundering and counter-financing of terror requirements prescribed in the Financial Intelligence Centre Act, 2001.

With regard to the changes on emigration, under the proposed new system, natural persons (emigrants and South African private individuals) will be treated identically, subject to capital flow management measures. The aim is to level the playing field between South African private individuals and emigrants, subject to tax obligations being met.

While ongoing engagement between Treasury, industry stakeholders and other stakeholders is ongoing, clarity has now been given on two measures designed to support trade and investment:

When the above was announced, the SARB also issued a circular in which they reclassified, as domestic, all inward listed debt, derivatives and exchange traded instruments referencing foreign assets traded and settled in South Africa in rands. Unfortunately there was some confusion regarding the impact of this on the investment industry so, in order to address this matter, the circular has been withdrawn and the SARB has requested comments from the public. We will participate in this process and will hopefully have more news to share soon.

Looking at these proposed changes from a broader perspective, Robertson notes that they are more in line with global thinking. "When you speak to a foreigner looking to invest in South Africa, they often struggle to understand exchange controls as it is a foreign concept for them, but they are well aware of capital flow measures since most developed countries have these type of systems in place, predominantly for reporting and compliance reasons," she says.

Touching on tax

Also tabled during the MTBPS were two draft tax bills which have tax implications for South African expats and private individuals.

With financial emigration officially coming to an end on 28 February 2021, the Taxation Laws Amendment Bill is seeking to deal with pension/retirement funds that were previously dealt with in terms of exchange control policy. It is worthwhile staying close to these changes as it provides some insight into what to expect on the exchange control changes.

Unpacking the perceived intention behind these tax amendments, Robertson explains that "the aim is to create a level playing field between South African individuals and emigrants, subject to tax obligations being met". She adds: "By treating all South African residents the same from an exchange control perspective, regardless of where they are living and working, you support the mobility of global citizens, both from an inward and outward investment perspective."

In short, the possible changes that will come into effect over the next 12 months will be a significant departure from the exchange controls system. While the framework has not yet been finalised we will unpack further developments as they transpire and will keep you informed should additional amendments be available.

With global and local recessions looming, high unemployment numbers combined with financial pressures on both individuals and businesses, fraud attempts will continue to rise. While various sectors of the economy count the cost of lockdowns and pandemic-related regulations, fraudsters continuously change their modus operandi as they target those who let down their guard.

As the end-of-year approaches, vigilance is essential to ensure that you and your family do not fall victim to fraud this festive season. Please take note of the following fraud preventative information.

Fake fraud department calls

Fraudsters might claim to be calling you from FNB's fraud department to assist you with a fraudulent transaction or debit order. The purpose of such a call is to obtain sensitive information from you such as your OTP. The fraudsters might also ask you to initiate a transaction on the FNB App or FNB Online Banking as part of the fraud reversal process. This is a scam!

Contact our fraud department immediately when your cellphone is lost or stolen

The FNB App and FNB Online Banking are both extremely secure channels which require password access. Sometimes customers

unwittingly save these crucial banking passwords on their mobile devices, in the cloud or via their web browser.

It is for this reason that you should immediately contact FNB through the 24/7 fraud desk in the event of your mobile or smart device being lost or stolen. This will allow us to delink your lost or stolen device from your banking profile.

Don't get caught on the phishing hook

A phishing attempt is when you receive an email or message which entices you to open an attachment or click on a link that leads you to a fake website, which mirrors the real banking website. Once you've logged into this fake site, this effectively hands the fraudsters your credentials and access to your accounts. By making sure that you always log into the official and secure FNB Online Banking website you make sure that the site is always the real deal. NEVER access a site by clicking on links or attachments.

Guard against ATM shoulder surfing and card fraud

Since 1981, when the first ATMs changed the way we get cash, deposit cash and bank, these handy machines have sprung up all around South Africa. Even in this digital age they continue to offer a simple, effective and efficient way to bank. But it's vital to be vigilant when using these devices. Shoulder surfing is just one method used by fraudsters to take your cardand view your PIN details while you are using an ATM.Shoulder surfing can happen anywhere and to anyone, but you can protect yourself by not allowing anyone toassist or interrupt you while at the ATM. Be aware of your surroundings and those around you. Alternatively withdraw your money for free with FNB Cash@Till at Checkers, Shoprite, Pick n Pay and select Spar tills.

Enjoy digital peace of mind,

The safety and security of the FNB App and Online Banking ensures secure, flexible and self-sufficient banking at all times. Using these digital channels allows you to quickly and securely manage your cards and accounts.

On the FNB App, at a touch of a button you can:

Finally, remember that fraudsters are innovative and employ various techniques in an attempt to defraud people by means of various scams. This can range from holiday accommodation scams, romance scams, advanced fee schemes, business email compromise scams where emails are intercepted and banking information changed as well as WhatsApp scams where messages contain links or false information.

Trust your instincts, be ever vigilant and don't fall prey to tricksters and fraudsters.

If you suspect fraudulent activity on your account, then immediately contact the FNB fraud hotline on 087 575 9444 (or +27 11 369 2924 if you are dialling from abroad).

Top tips to help you outwit fraudsters

For many, COVID-19 and the resurgence of lockdown measures around the world have derailed end-of-year trips and long-awaited family get-togethers. But that doesn't mean the holidays have to be a damp squib. For the intrepid online enthusiast a world of unique and fun experiences is just a click away, offering a range of fun ways to connect with the people who matter the most in your life - but from the comfort of your couch.

1. Flex your grey matter

Larry Benjamin hosts the best quizzes in Johannesburg. He offers diverse and fun categories from stage and theatre, to picture quizzes, sport, music and 'who am I'. And, in 2020, he rolled out an online offering. Gather a team and sign up with Quizwizz to enjoy weekly online quizzes that include a Thursday Speed Quiz, corporate quizzes and more. Pricing ranges from R320 and R480 for four quizzes.

For more information visit:

www.quizwizz.co.za/quizzes-view/quizzes-during-covid-19/

2. Touring with your Airbnb host

With lockdowns stopping global tourism in its tracks, Airbnb hosts needed a plan B. They came up with a bevy of virtual experiences from online cooking classes, coffee masterclasses, cultural tours and celebrations, and even sangria parties. If your tastes run to the food and culture of Mexico, for example, then join Carlos in Mexico City for his Mexican Food Game Día de Muertos Edition. Carlos has designed an entertaining event around the Mexican foods that have impacted the world, from fruits and vegetables toinsects and spices. Expect to be sprinting around your house searching your cupboards for examples of Mexican food in your home... you'll be amazed how many are hiding in your pantry!

For more information visit Airnb experiences and search for Carlos in Mexico City

3. Enjoy Italy with Shakespeare

If you are a Shakespeare enthusiast, then why not experience Shakespeare's Italy? Did you know that over 40% of Shakespeare's plays were set in Italy? Even more interesting is that it is widely held that Shakespeare never set foot in the country. In this enchanting hour-long experience you'll whiz through Venice, Padua, Verona and Rome, with maps, pictures and a quiz supplementing a range of fascinating historical and linguistic tidbits. By the end of tour you'll definitely have learnt something new; making this is a must for anyone looking for a new take on the Bard.

For more information visit:

https://seeyour.city/tour/shakespear-italy/

4. Unlock the escape room

This top-rated online experience is a must for lovers of puzzles and games and will keep you enthralled for between one and two hours. T.R.A.P.T. is a US-based entertainment company that specialises in creating escape rooms. In early-2020 they launched an online escape room game called Project God-Particle, which featured five rooms to unlock. Navigating the maze of information takes serious collaboration and some serious out-of-the-box thinking. Currently only one online game is available, but a new offering is due out before the end of the year. This one is definitely worth the R200 per computer that it costs to play.

For more information visit:

https://www.traptct.com/

5. Night at the ballet

Even if you aren't a passionate fan of the ballet you might be convinced to enjoy a night in celebrating the elegance and talent from afar. Gather the kids and the dogs and settle down with a glass of your favourite wine for an unforgettable and world-class experience. One ballet that really sets the tone for the holiday season comes courtesy of the Washington Ballet, which is offering the Nutcracker Suite as a December special - including behind-the-scenes content.

For more information visit:

https://www.washingtonballet.org/events/virtualnutcracker/

6. Operatic extravagance

Fans of opera would be hard-pressed to imagine that the sheer magnificence of a highly-trained voice could be captured adequately through a computer or a television speaker. But, somehow, it can. For just US$20 the very best of The Metropolitan Opera is at your fingertips, from South Africa's own operatic sweetheart, Pretty Yende, to the effervescent Renée Fleming, Javier Camarena or Sir Bryn Terfel. Check out Metstarslive and dive into a wealth of top-quality virtual performances being streamed from around the world.

For more information visit:

https://metstarslive.brightcoveservices.com/

7. Broadway's best

Broadway HD is the Netflix of stage performances. For just US$8.99 per month, or US$99 per year, you can access hundreds of virtual plays, musicals, ballets, operas, comedies and more. Over December, when work and school commitments calm down, why not try out a seven-day free trial and hit the town for a virtual evening with friends? From Death of a Salesman to Romeo and Juliet, Funny Girl, or Peter Pan the choice is yours...

For more information visit:

https://www.broadwayhd.com/

8. Virtual space tours

And for the kids we wrap up with a virtual space tour. Who doesn't like space? NASA Kids Club offers younger children hours of fun, while older kids and adults may find NASA at Home more intriguing. For those keen to beam themselves onto the NASA facility there is a virtual facility tour which offers pictures, videos, information and 360-degree views of all the different sections of the giant facility. Be warned,however, you can lose yourself for hours, so make sure you have loads of free time to enjoy everything NASA has to offer. And, if you want more, then the NASA's website is a treasure trove of information.

For more information visit:

https://oh.larc.nasa.gov/oh/ (Nasa's Virtual Tour)

While the world of online experience beckons, remember there is a codicil: The secret to enjoying online activities lies in gathering a group of people together to enjoy the event with you. Even if you are all scattered around the world in different locations, a WhatsApp group chat allows you to chat, pass comments and ask questions during these amazing shared experiences.

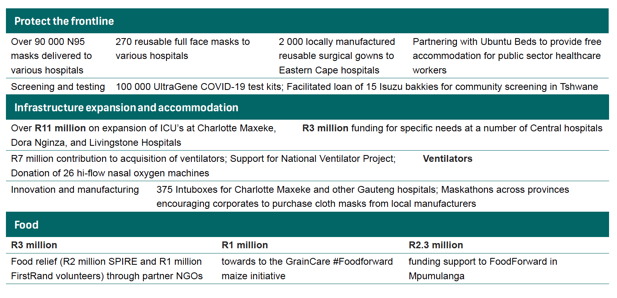

During the past quarter South Africans have been bombarded with news of economic malaise, lockdown blues and news headlines highlighting the plight of many people as a result of the containment measures put in place to fight the current pandemic. It's hard to stay positive and see the light at the end of the tunnel, but there are green shoots which we can, and must, celebrate.

The first is the unwavering generosity of South Africans, which FNB Private Wealth and the greater FirstRand Group have witnessed in the flood of donations being made to our South African Pandemic

Intervention and Relief Effort (SPIRE) initiative. We thank each and every one of you who has made a contribution for your humanity, your care and your kindness.

In this newsletter we highlight another focus on caring for elderly communities and specifically those in old age homes by providing much-needed personal protective equipment. We provide details of how you can donate to this worthy cause, either by making a cash donation or by contributing your eBucks.

For our clients who are retirees or who are knocking on the door of retirement, we are also delighted to share some good news: in the form of our new Retirement Solution offering. Given the pressure on retirees, many of whom are seeing their monthly incomes eroded as a result of market movements and interest rate cuts, we have created an option which not only offers support during the immediate COVID-19 crisis but also offers long-term benefits in the form of preferential rates, private banking perks and tangible rewards.

FNB Private Wealth is not the only organisation adapting to the pressures of the moment. With uncertainty around incomes and with livelihoods under pressure, many South Africans are turning to the 'side hustle' to augment their incomes. Keen to know more, we enlisted the help of Nic Haralambous to talk us through this concept and to share his insights on this dynamic aspect of our future economy.

Of course, when it comes to navigating this strange new world, there are considerable stressors at play. Therefore, we are happy to outline some of the insights that author and human potential expert Nikki Bush shared with our staff and clients during a well-attended webinar. She offered both insights and recognition of the feelings of frustration and angst, which are welling up in us all. By applying her tips, it is possible to find that illusive balance.

We also hope you will find value in the insights from global strategist and speaker Abdullah Verachia, whose new book, Disruption Amplified: Reset. Rewire. Reimagine Everything, outlines the shifts impacting the profound changes playing out globally and who gives us a taste of how virtual engagements will evolve in the months and years to come.

The world, says Verachia, is not in the midst of a 'new normal' but a new. And this brings countless opportunities. One is in the agriculture space where the impact on global supply chains is creating potential for Africa's agricultural sector.

Stay well, stay safe and stay strong.

CEO, FNB Private Wealth

The potential impact of the COVID-19 crisis on African economic growth forecasts does not make for comfortable reading. This has wide implications for vulnerable communities, for those in extreme poverty, for companies and individuals employed in the informal sector. It is also impacting retirees and those about to take formal retirement.

An analysis by the Institute for Security Studies, the Frederick S. Pardee Centre for International Futures and the Gordon Institute of Business Science signals that the continental economy will be between US$349 billion and US$643 billion smaller by 2030, depending on the severity of the impact. This will put businesses under pressure, see unemployment rising and put an additional 38- to 70-million people into poverty. Social grants will increase, tax collection will be under pressure and so will incomes.

"This has notable knock-on effects for those currently in retirement and depending on fixed incomes, as well as those South Africans planning and saving for their retirement," says Eric Enslin, CEO, FNB Private Wealth.

With salaries being reduced, some companies and individuals are already seeking relief in terms of their retirement fund contributions. And many pensioners are seeing their monthly income reduced as a result of market movements and interest rate cuts.

"In light of these pressures on retirees, FNB has created a Retirement Solution that aims to help retirees through the immediate COVID-19 crisis and support them in subsequent years through a combination of preferential rates, reduced transactional account fees, private banking perks and rewards which put money back into their pockets," explains Enslin.

"By offering better rates, adding more options and increasing the rewards available to our retired clients, we hope to offset - to some extent - the impact of the current crisis so our clients can continue to enjoy the lifestyle they have worked so hard to achieve."

Reduced transactional account fees

One of the most attractive aspects of the Retirement Solution offering is that retirees stand the chance of paying no monthly fees or enjoying a reduced 50% monthly account fee on their FNB Private Wealth account.

How this works in practice is that clients with R2 million in a qualifying FNB Investment accounts will have their full monthly account fee rebated. If they hold qualifying investments of R1 million with FNB Private Wealth, they will receive a 50% rebate.

Preferential rates

Recognising the pressures on those living off fixed incomes, the Retirement Solution also offers attractive preferential interest rates on fixed deposits, which enables retirees to increase the monthly income drawn from their investments - even while interest rates go down.

According to Himal Parbhoo of FNB Savings and Cash Investments, there are options that people can consider to lessen the impact of COVID-19 and the associated rate cuts on their finances.

"FNB's response to supporting its clients through the crisis includes giving consideration to offering seniors truly competitive interest rates on their Fixed Deposits, with the benefit of having the interest paid out monthly to supplement income." He therefore encourages clients with FNB savings or deposit accounts to contact their bankers to discuss their interest options. He notes that clients can also discuss blending their savings products more effectively to maximise both the growth and income components of their cash portfolios, also considering Tax-Free Cash Deposits.

Finally, Parbhoo emphasises that seniors should view the lockdown situation as a valuable opportunity to change the way they bank and thereby benefit from the convenience and security afforded by digital platforms.

Quality advice

While banking fees are being reduced, the access and quality of the expert advice and banking support on offer remains the same. In fact, given the greater complexity of your financial arrangements in retirement, the level of holistic banking support is increased to cover everything from investments and lending to risk and fiduciary advice.

At the same time, Retirement Solution clients will qualify to pay reduced attorney fees and discounted estate administration fees. Furthermore, their families will receive guidance and support through the deceased estate administration process at a discounted fee.

Other advantages, from discounted bond registration attorney fees and preferential rates on home loans also apply.

As well as innovative options to enable you to capitalise on your assets; such as leveraging the equity in your existing property to stand surety.

More rewards

Finally, Retirement Solution clients can now spend and earn in eBucks on everyday purchases at Checkers, Engen and Takealot.com. "It is our aim to support clients who are heading into retirement or who are already living off their investment income to get the most they can out of their years of planning and investing," says Enslin. "By offering better rates, adding more options and increasing the rewards available to our retired clients, we hope to offset - to some extent - the impact of the current crisis, so our clients can continue to enjoy the lifestyle they have worked so hard to achieve."

The side hustle may just be the kick-start a decimated economy needs to get South Africans earning again. How many people do you know who've spent lockdown making masks, or offering exercise classes online or taking a job as a delivery driver to tide them over? Other stories include shifting into offering ready-made meals and even selling Italian-style ice-cream online.

Each of these stories is one of perseverance and spirit. But the longer-term impact of this fresh approach to work is even more fascinating than the short-term boost it offers.